One of the puzzles associated with investing in “Digital Assets” is figuring out a rational and defensible means for valuing them. It’s a challenge for individual investors and an imperative for institutional investors like Ulu Ventures.

The truth is, there doesn’t appear to be a widely accepted method for making this important calculation, so we undertook to construct and articulate our own. The process involved in-depth conversations with attorneys, academics, auditors (ours and others), industry luminaries, and literature searches.

In the spirit of both transparency and contribution to an important industry-wide challenge, what follows is our best thinking. We hope Ulu’s views starts a useful conversation on this important topic.

For the purposes of this discussion, the term “Digital Assets” includes cryptocurrencies, decentralized application tokens and protocol tokens, blockchain-based assets and other cryptofinance and digital assets, as well as instruments for the purchase of such.

In our view, the fair market value of a Digital Asset takes into consideration:

- the purchase price of the asset,

- likely adoption and use of the asset over time

- the changing value of any underlying assets to which the digital asset has contractual claims

- any contractual restrictions on sale of the Digital Assets

- and any other factor or factors the investor (eg the General Partners at Ulu Ventures) may in their reasonable judgment deem relevant

A Definition of Value

At Ulu Ventures, our value equation is driven by four core criteria. We call this model our “Four Pillars for Valuing Digital Assets.”

PILLAR 1: Value should represent long-term, intrinsic value, not short-term volatility

We begin with a view we are investors in digital assets, not speculators, so the periodicity of our observations and calculations should reflect our time horizon and our reporting needs. We value digital assets once per quarter, at the end of each quarter, just like other investments. We intend to be long-term holders of any digital assets and a once-a-quarter cadence of valuation is consistent with this view.

Our value calculations are based on the weighted average price of the asset over the quarter. This will have the effect of helping to smooth out the sometimes dramatic fluctuations in price typical of many digital assets.

PILLAR 2: Value should include a liquidity risk discount based on objective measures

The thinly traded nature of many digital assets suggests the prudent path is to apply a discount. After much discussion with experts, we determined there is no “right” (industry-standard, legally required, or GAAP-compliant) level of discounting. Hence, we will apply anywhere between a 0% to 90% discount depending on the asset and our own reasonable judgment.

Ulu’s views of what is a reasonable discount are informed by how long we believe it would take us to exit our position given the average daily trading volume over the last quarter.

Finally, we believe liquidity risk should only be applied to gains in the early stages of the market, all else being equal. Just like our other investments, we initially anchor value on our purchase price, which we believe to be a strong initial signal of market value. If we applied a liquidity discount to our cost basis, we could show wild fluctuations in value immediately after purchase. We would argue that would not be an accurate reflection of value for a long-term investment.

PILLAR 3: Value should be comparable with value as calculated for any other startup investment

We believe it’s important to factor out any digital asset specific taxes and costs to give our institutional investors a more accurate sense of performance. This point is idiosyncratic to how we structure our digital asset holdings because of the nature of our limited partners base and may not apply to other investors. General Partners with institutional investors that include pensions, endowments or sovereign wealth funds may find that tax risks unique to their limited partners drive their decisionmaking about corporate structures to use in investing in digital assets.

We calculate the interim value of any digital asset net of any taxes or unique costs specific to that digital asset. The ultimate calculation of value will, of course, include standard fund fees, carry, and any other expenses that also apply to all other assets in our portfolio.

PILLAR 4: Value should be based on a consistent set of considerations

Considerations should work for both early markets with limited price signals and trading volume as well as more mature markets. We list this pillar fourth, but it may be the most important of all. It is both prudent, and aligned with two of our core values – that we be rational and transparent in how we value our investments through their full lifecycle in Ulu’s portfolio.

Our goal is to maintain the same valuation criteria and approach over time. Having said that, the crypto world may change in material ways that would cause us to reconsider our valuation criteria or approach. When that happens, we will be transparent about any changes to valuation criteria or approach we make.

A Sample Calculation

We can express our four pillars in this example, through the following equation:

Asset Value = Cost + (Weighted Avg Token Price-Purchase Price) * Liquidity Discount * (1-Tax rate) * Tokens Held

- Cost: the initial cost to purchase the assets

- Weighted Avg Token Price: weighted average token price over the last quarter

- Purchase Price: price per token at the time of purchase

- Liquidity Discount: value between 0% and 90% that represents potential limitations on Ulu’s ability to sell its position. The precise value is based on the size of Ulu’s position relative to the preceding quarter’s trading volume as well as company, financial, market, and other considerations which may limit Ulu’s ability to sell.

- Tax Rate: estimated combined US federal and applicable state tax rate on any gains

- Tokens Held: total number of digital asset tokens held

If there is an insufficiently active market due to the early nature of the project, we hold digital assets at cost.

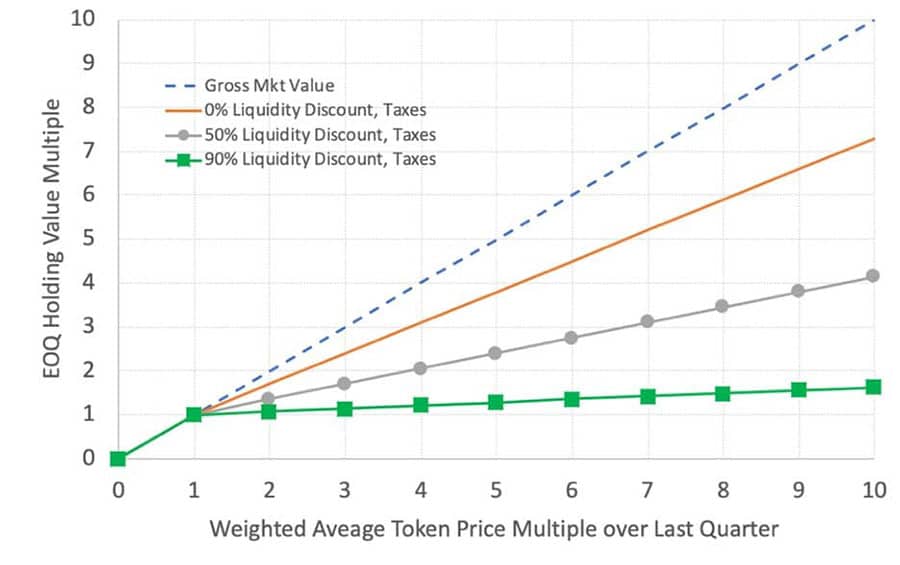

Ulu’s digital asset valuation policy can be represented graphically as follows. The graph is driven by actual calculations valuing one of our holdings.

The x-axis represents the Weighted Average Token Price Multiple over the last quarter. We start with multiple instead of the actual token price to highlight the difference between the increases in the token price and the smaller reported increases in our holdings. The y-axis represents the End of Quarter (EOQ) Holding Value Multiple which we multiply by the cost basis of Ulu’s holdings to calculate final value.

The blue dashed line (top line in the chart) represents the gross EOQ Holding Value Multiple. There is a 1:1 correspondence with Weighted Average Token Price Multiple.

The red line (second from top) represents the reduction due to taxes on gains, currently approximately 30%, between federal and state taxes. Below 1x Weighted Average Token Price Multiple, there are no gains or taxes, hence the gross Holding Value and the net of tax Holding Value are the same and the dashed line and the red line perfectly overlap.

The grey (third / circle) and the green (fourth / square) lines represent the reduction due to both taxes and a 50% and 90% liquidity discount on gains respectively. As previously mentioned, we do not apply a liquidity discount to the cost basis of our investment; hence the gross Holding Value and net Holding Values are the same below 1x Weighted Average Token Price Multiple and all of the lines overlap.

The solid black vertical line at 8.5x represents the weighted average token price for Q3. This line intersects the 90% liquidity discount line (our current liquidity discount level) at the red circle. Referring back to one of our holdings, this translates to a 1.53x EOQ Holding Value Multiple. In other words, we are marking up an initial $1.5M investment to $1.5m * 1.53 = $2.3M.