Doubling down on your winners doesn’t always make sense

When AppDynamics was acquired by Cisco just before its planned initial public offering, reports credited early investor Greylock Partners with a return of 100x on its investment in the San Francisco-based enterprise software company. That report was soon amended to reflect that Greylock’s overall return was closer to 25x, returning an impressive $590 million on a $23 million investment made during six capital raising series. The disparity between the two accounts highlights the huge difference in returns between investing early in startups and in later rounds. In this case, Greylock had invested $3 million in AppDynamics’ Series A round funding, returning $300 million, or 100x. The famed VC fund — one of the best in the business — subsequently invested another $20 million in Series B through Series F rounds, for a 14.5x return.

The lesson here is that the conventional wisdom among Silicon Valley venture capitalists — that you should always double down on your winners, investing early and then putting in more money in subsequent investment raises — is wrong. Like lots of conventional wisdom, the facts don’t support the theory. It’s a topic that family offices, limited partnerships and others looking to invest with VCs should fully understand before choosing the right partner to work with.

In well-performing companies, the strategy of doubling down on winners results in meaningfully lower ownership compared to what you would have achieved by putting in more up front. Having the courage of your convictions and committing more capital earlier in the cycle is the better path to VC nirvana, especially for small, seed-stage funds, such as Ulu Ventures.

The reason the strategy of doubling down on winners does not work for small funds is because as the price of each subsequent round rises, investors often have to pay astronomically higher prices per share to maintain the same ownership.

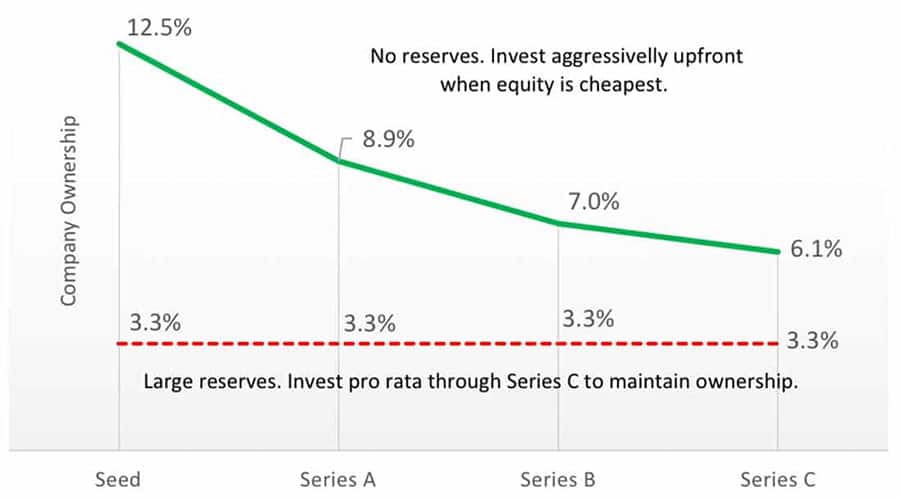

In a well performing seed fund, a VC investing everything in Seed rounds (holding a 0 percent reserve for subsequent rounds) purchases 12.5% in their winners which is then diluted down to 6.1% by the Series C. By comparison, a VC reserving enough to maintain ownership through Series C (roughly $3 for every $1 invested) starts with and ends with 3.3% ownership in their winners.

The red line in the chart above illustrates a model portfolio of a well-performing seed fund following a double down on winners through Series C strategy. This fund generates a 3.4x net multiple. The green line illustrates the same model portfolio and just changes the reserve strategy to no reserves. This same fund now generates a 6.4x multiple. And, as shown in the graph above, the fund’s ownership in winner companies is nearly double with the no reserves strategy.

While a rigid strategy of doubling down is wrong, like many things, there are exceptions to the rule. There are three key reasons where it may make sense for a VC to double down.

- For large, successful players — such as Greylock — they simply cannot invest all their available funds in seed and Series A rounds, so they have to keep investing in later rounds to put all their cash to work.

- To support entrepreneurs a VC believes in but who have not yet garnered enough traction to convince other investors. These are not “winners” so are still reasonably priced. It’s worth stressing that most real winners — such as SoFi or Palantir — tend to have investors tripping over themselves to invest capital once they’ve gained traction. Early investors continued financial support is not needed as a signal of value.

- Perhaps oddly, doubling down can be a good strategy for poorly performing funds. For example, if only a small percentage of a VCs investments receive follow-on financing, the return on reserves is likely to be higher than the return on the initial investments.

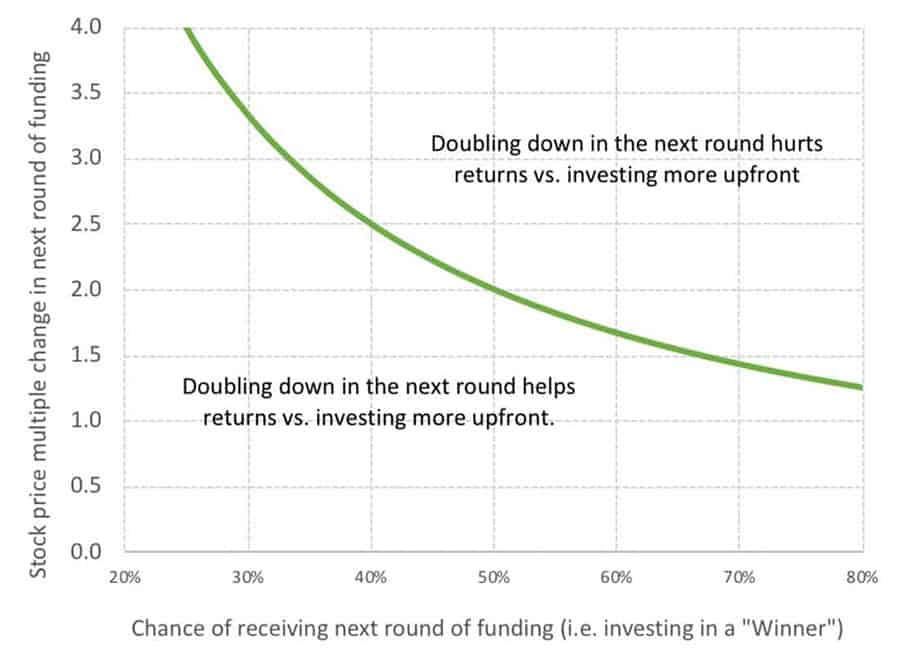

Well-performing funds, operating in the top right quadrant, will increase returns by investing more upfront and less in follow-ons.

If a company’s stock price increases significantly in the next round (the y-axis), fund returns are generally improved by investing more in the initial round when equity is less expensive. Some of Ulu’s best companies have had stock price increases of 10x between their seed round and their Series A.

Fund managers with a high hit rate selecting companies that receive follow on funding (the x-axis), are also generally better off investing more capital upfront.

A successful reserve strategy depends on both on the chance of picking winners and the step up in value at the next round. The green line in chart 2 shows when the returns on initial investments are the same as returns on follow-on investments. In other words, along this line, the strategy of doubling down on winners and the strategy of no reserves generate the same returns. In mathematical terms, this happens when the stock price multiple increase * probability of receiving funding = 1.

Skilled early stage investors operate above the green line. Many of their companies receive follow-on funding at large increases in stock price value. These funds improve returns by investing more capital early saving less for reserves.

This is a validated approach. 67% of Ulu’s 64 companies in fund I received follow-on funding with an average increase in stock price of 2.9x. This puts Ulu above the green line and so we followed a strategy of investing most our capital in early stage rounds. Ulu Fund I currently has a 5x net total value to paid in capital. Those investments included two startups with valuations over $1 billion each — Palantir and SoFi — and six that have grown in investment value by ten-fold or more.

On balance, for most early stage venture capital firms working with a limited supply of cash, investing more in the seed and Series A rounds is the smartest way to boost returns. Early stage funds with large reserves effectively become late stage funds on a dollar-weighted basis. Good early stage funds tend to do better when more of their capital is invested upfront when they have the potential for AppDynamics level returns.

For family offices, limited partnerships and others looking to invest with VCs, asking a couple of key questions will illuminate how this critical issue of doubling down can impact returns:

- How much of your fund is reserved for follow-on investments?

- How do you decide whether to invest in a follow-on round?

- And, what is the return on your reserves?

You may be surprised to find that many VCs will have confident answers to the first two without ever having analyzed the actual returns of their reserve strategy.

(This article first appeared as a guest column in the Venture Capital Journal March 2017)