When Lightspeed Venture Partners became the first outside investor in Snap, putting in $485,000 and then investing in subsequent rounds, it produced a return of $2 billion and instantly became the stuff of legend.

The deal marked Lightspeed’s third exit in quick succession, following the Nutanix IPO and Cisco’s purchase of AppDynamics, making it a giant among venture firms and reinforcing the widely held belief that great VCs can pick winners.

The Power Law argues otherwise. Returns in venture capital are distributed according to a Power Law with the lion’s share of returns earned from a small number of investments. The data demonstrate this distribution to be true across the industry and even within firms.

In short, VCs cannot reliably pick winners. They can, however, construct portfolios that consistently generate great returns.

Simply stated, more investments give a venture firm better odds of investing in an outlier company that can make a fund. However, there are limits. Portfolio construction requires weighing the benefits of diversification against a VC’s ability to generate and support high-quality investments. Striking the right balance separates great VCs from the rest.

Let’s start with an extreme. The best financial performance possible would be generated by investing all fund capital in the early rounds of an outlier, think Facebook or Google. However, putting all your eggs in one basket isn’t savvy portfolio construction, ifs gambling. Savvy VCs determine portfolio size based on an intellectually honest assessment of the odds.

Consider the evidence. Research from Cambridge Associates shows that as an industry, VCs pick winners only 2.5 percent of the time. More than a decade of data reveals that out of more than 4,000 VC investment rounds annually, the top 100 generate between 70 and 100 percent of industry profits.

Horsley Bridge data indicates that, among the very top performing VCs, 4.5 percent of invested capital generates 60 percent of their funds’ returns. When Kleiner Perkins Caufield & Byers in 1999 invested $12.5 million in Google for a 10 percent stake, its hugely profitable fund would have been underwhelming without that outlier investment.

In short, the data show that venture is an extreme outlier business where a small number of investments drive most of the returns. Even the best firms have many more misses than hits. If a VC has an outlier in a fund, like Lightspeed’s investment in Snap, fund returns are likely to be well north of the 3x net multiple LPs desire. On the other hand, a fund with no outliers, will struggle to achieve this milestone.

A key question for LPs, especially for investments in early-stage funds, is “What is the chance of an outlier in your fund?”

The answer is driven by two key factors: the probability of each investment being an outlier and the number of investments in the fund.

Let’s explore portfolio construction for three different types of VCs.

Chance of Outlier

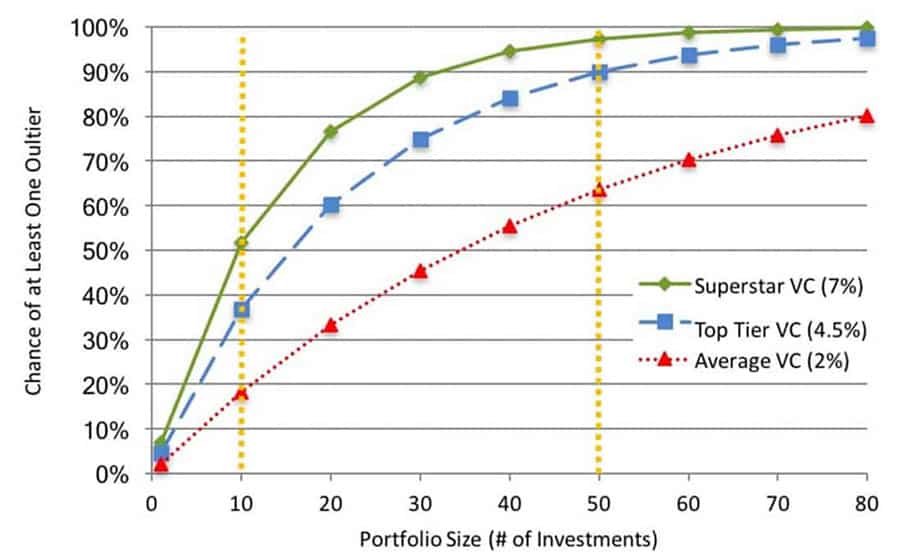

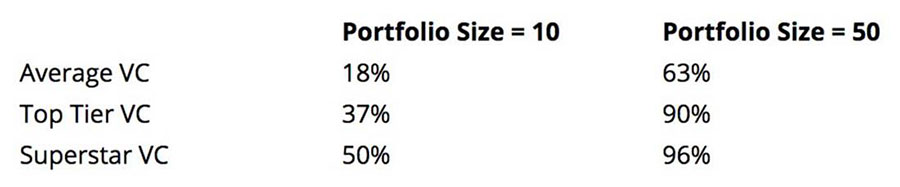

The “Chance of an Outlier” chart below shows the chance a venture fund will have at least one outlier investment as a function of the capability of the VCs (average, top tier, and superstar) and the number of investments in the portfolio.

Successful VCs need at least one outlier to have a well performing fund. The y-axis measures the chances of investing in at least one outlier as a function of the size of the portfolio (the y-axis) and the chance of an outlier with each investment for 3 different types of VCs (the colored lines).

- Average VC (red dashed line) has a 2% chance of an outlier with every investment. This based on reducing the Cambridge Associates industry average of 2.5% a bit to remove top tier Investors.

- Top Tier VC (blue dashed line) has a 4.5% chance of an outlier success with every investment. This based on the Horsley Bridge data.

- Hypothetical Super Star VC (green solid line) has a 7% chance of an outlier success with every investment. This hypothetical VC is 50% better than the top tier and is useful in testing the”! can pick winners” assertion given by firms with concentrated portfolios.

Reading from the chart we can calculate the chance of at least one outlier in the fund for a variety of portfolio construction strategies.

The right portfolio size is still a judgment call based on risk tolerance, opportunity set, support model, etc. However, this analysis does show the challenges with a small portfolio. Even the Superstar investor, who is 50 percent better than the top tier VCs, only has a coin flip of a chance of an outlier with a small, concentrated portfolio of only 10 companies.

Some VCs contend this analysis doesn’t apply to them, pointing to their concentrated portfolio and great performance as proof. However, funds can make bad decisions and still have a good outcome thanks to luck.

The average VC with a concentrated portfolio of 10 investments only has an 18 percent of investing in an outlier. If there are 100 such funds, odds suggest 18 of them will have an outlier success! Even a broken clock is right twice a day. But, repeatable great performance requires principled, portfolio construction based on an intellectually honest assessment of the odds.

At Ulu, we have chosen 50 as our minimum portfolio size. We believe our capabilities are comparable to the top-tier VCs, the above caveats notwithstanding, giving us a 90 percent chance of having an outlier in our fund. More investments would provide more diversification, but with only two investing partners, making more than 50 investments would risk sacrificing quality or our ability to support our companies.

Even to accommodate our many investments, we manage our companies differently than most. For example, we systematically roll-off seed stage boards when our companies obtain Series A funding. When we feel our companies are in good hands after the Series A, which is often, we are able to reallocate our time to our next new investment.

Our informal research indicates that portfolio size is more often driven by notions of bandwidth (number of boards a VC can serve), than by the data on odds of success. For large firms, this model still results in a diversified portfolio. A firm of seven partners making one to two investments per partner per year over a five-year investing period results in a portfolio of about 50 investments. However, when applied to small funds with only one or two partners, the board seat constraint results in portfolios of 10 to 15 companies, falling into the “hope the coin flip goes our way” portfolio construction category.

Like any rule, there are exceptions. Focusing on outliers is not the only successful risk/reward model. For example, Aligned Partners invests in early-stage companies with a lower risk profile and a shorter time to exit, a strategy that serves its investors well. Performance in late-stage venture, while not as extreme as early stage, is still driven by outliers.

For most seed-stage VCs, getting portfolio construction right greatly boosts the chance of success. Family offices, limited partnerships and others looking to invest with VCs often like to ask what a fund’s loss ratio is, hoping that a low number will be a predictor of strong returns.

However, the reality is that even great funds have high loss ratios and low success rates, so the better question to ask is, ‘What is your chance of an outlier?”